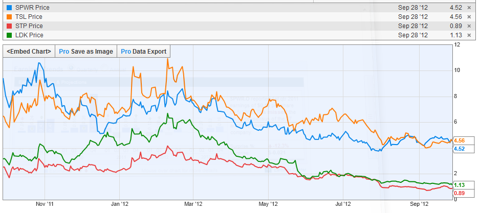

The leading supplier for the U.S. residential (rooftop) solar market is SunPower (SPWR).

We haven't previously taken any notice of this company in our writings

about the industry, and that should be redressed. SunPower really is an

interesting company. Below you can see its relative performance versus

some of its peers:

Unlike

most other solar companies, SunPower hasn't raked up large losses. One

of the reasons they're doing better than the average solar company is

that they have a strong presence in markets that are growing very well,

like the U.S., Japan, and Italy. Their strong domestic position (69% of

revenues come from North America) in the U.S. is particularly helpful,

as margins in the U.S. are a lot higher than in Europe.

Europe is

usually the most important market for almost all other solar companies,

due to the fact that Europe still is the largest solar market by far.

Net margins (non-GAAP) stood at 19.1% for North America in the last

quarter. Compare that to the margins in its two biggest markets in

Europe, Germany and Italy (a combined 3.1% gross margin) and it becomes

instantly clear.

Strategy

Management explained during the Q2 conference call that they are focused on four key strategies:

Management explained during the Q2 conference call that they are focused on four key strategies:

- Downstream global channels

- Technology leadership

- Cost reduction

- Maintaining strong balance sheet and liquidity

Global channels

Well, SunPower indeed has a global presence, although the home market (U.S.) is still by far the most important for them at 69% of revenues. They are the leader in residential rooftop. One reason for this is their cell efficiency (see below), another the 2000+ dealerships they have all over the country.

Well, SunPower indeed has a global presence, although the home market (U.S.) is still by far the most important for them at 69% of revenues. They are the leader in residential rooftop. One reason for this is their cell efficiency (see below), another the 2000+ dealerships they have all over the country.

Total (TOT) of France has taken a 66% stake in SunPower, and its CEO Christophe de Margerie argued that SunPower would be bankrupt without it. There are some notable advantages:

SunPower, along with First Solar, was one of the first solar panel manufacturers to aggressively pursue utility-scale projects and to develop its own solar parks. Having Total as a financier will potentially help SunPower circumvent the often-arduous search for money and partners on particular projects. [Greentechmedia]

Indeed, they've put in place about a $1B credit facility at "very reasonable rates."

Total

also added $25M to SunPower's $40M annual R&D budget. But Total

also greatly helps increasing SunPower's global footprint, especially in

emerging markets:

In South Africa, we are currently in the final product stages for financing 2 large, ground-mounted projects totaling 30 megawatts. Our local footprint was a key element behind these project wins. As many of you know, Total had very deep presence throughout most of Africa, and we are working increasingly closely with them to develop additional business opportunities in this region.

In another rapidly growing market, Japan, the company benefits from partnering with Toshiba.

On to Asia Pacific. Our primary Asia-Pacific focus is currently on Japan, where our local market characteristics favor our high-efficiency product. We continue to benefit from our well-established channel to market via partnership with Toshiba as reflected in our strong volume in Japan in Q2. [Q2CC]

Japanese

houses are notoriously cramped, making it one of those 'space

constrained markets' where SunPower has a leg up with its more efficient

cells compared to the competition. On September 12, the company

announced that it was going to supply Toshiba with more than 100MW in panels.

Product leadership

SunPower has some of the most efficient commercial solar cells in the business. Here is CEO Wenger:

SunPower has some of the most efficient commercial solar cells in the business. Here is CEO Wenger:

"Other manufacturers' cells," Wenger said, "are on average 16 percent efficient. We're 24 percent efficient. That means you need 50 percent less roof area for the same power output, 50 percent less steel, 50 percent less labor. On a per-unit basis, this is more expensive, but on an energy basis, it is not." [Greentechmedia]

This

provides the company with a significant advantage, especially in

segments where space is constrained, like rooftop installations. It also

allows the company to charge premium prices. But there is more:

SunPower "plowed through 3 million module-years of data, just like an insurance company," Wenger said. "We learned our product is not only a great performer, it's more reliable." The result is SunPower's offer of "a 25-year performance warranty and a 25-year product warranty," Wenger said. "For 25 years, if anything goes wrong with that panel that is a defect of our product of any kind, we will replace it at our cost. The industry standard for that piece is five to ten years." [Greentechmedia]

The company has another promising product, the C7 Tracker, which

combines single-axis tracking technology with rows of parabolic mirrors, reflecting light onto 22.8 percent efficient SunPower Maxeon™ solar cells, which are the world's most efficient commercially available solar cells. Using mirrors to reduce the number of cells required to generate electricity lowers the LCOE by up to 20 percent compared to competing technologies. For example, a 400-megawatt C7 Tracker power plant requires less than 70 megawatts of SunPower solar cells. [worldfutureengeneeringsummit]

Indeed, such is the technological prowess, according to Shyam Mehta:

"SunPower is one of the few solar companies that is actually a technology play and not a commodity one," according to Shyam Mehta, GTM Research solar analyst. [Greentechmedia]

Before

you get too excited by this, you'll have to realize that for investors,

the difference isn't all that important. As we know from the consumer

electronics business, even technology firms with state of the art

capabilities are not necessarily generating stellar returns for

investors.

Cost reduction

During the Q2CC, it became clear the company is running ahead of its own roadmap.

During the Q2CC, it became clear the company is running ahead of its own roadmap.

we are accelerating the pace of our panel cost-reduction roadmap and now expect the end-of-year 2012 blended cost per watt to be approximately $1.10. This is significant improvement versus our previous end-of-year goal of $1.25 per watt and 25% lower than our exit rate in 2011. We also expect that our leverage cost panels will achieve cost of approximately $1 a watt or below $0.75 per watt on an efficiency adjusted-basis, a full year ahead of our previous targets. [Q2CC]

While

these cost metrics are not industry-leading, SunPower is able to reap

price premiums due to their cell efficiencies and unprecedented 25 year

warranties. One also has to combine this with their BOS, or 'balance of

system' cost. These include the full installation cost and with panel

prices plunging, they are up to 2/3 of total cost. It's no surprise,

then that:

The vast majority of our customers now make purchase decisions on the basis of LCOE or total cost of ownership. [Q2CC]

Due to cell efficiencies, SunPower is in a good position to be competitive in BOS cost.

Leasing

Management argues that its highly efficient cells make it the perfect choice for space constraint rooftops and hence leasing. If the customer leases, they're cash flow positive from the start, with the leasing rates being less than their utility bills.

Management argues that its highly efficient cells make it the perfect choice for space constraint rooftops and hence leasing. If the customer leases, they're cash flow positive from the start, with the leasing rates being less than their utility bills.

The benefits of leasing are that:

it opens to market to a broader customer base. And so it's "taking" solar more and more mainstream. There is some pricing competition on lease. And interestingly, I think the competition tends to be more -- less on pricing but more on performance [Q2CC]

And, apart from having more efficient cells, they're a one-stop shop solution:

We make the module. We guarantee the quality. We service it. We make the monitoring. So everything comes from us and so if there's any issue, one place to get it fixed. [Q2CC]

Asked

about the returns, CEO Werner argued during the latest CC that average

returns on leased products would be 10% after tax. And it's growing very

fast:

We're at a rate of about 1.5 megawatts to 2 megawatts per week. So that's a substantial part of our business, and we think we're just beginning to expand this program. So it's easy for us to see in 1 year or 2 of becoming 20%, 25% of our total business. [Q2CC]

Balance sheet and liquidity

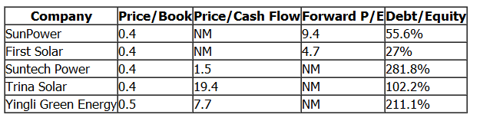

Contrary to many competitors, SunPower's balance sheet is still in relatively good shape. Cash and cash equivalents increased to $366M, and inventory was reduced by $65M. They're deferring most capital expenditures to 2014 in order to save cash. Nevertheless, debt stands at a considerable $693.5M.

Contrary to many competitors, SunPower's balance sheet is still in relatively good shape. Cash and cash equivalents increased to $366M, and inventory was reduced by $65M. They're deferring most capital expenditures to 2014 in order to save cash. Nevertheless, debt stands at a considerable $693.5M.

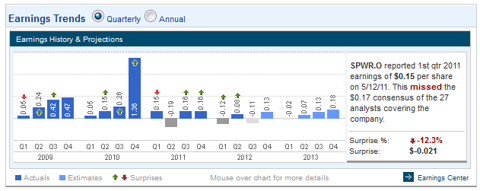

Gross margins, at 15.1%, are way above most of the competition. The company actually made a profit in Q2 of 8 cents per share,

while a loss of 9 cents per share was expected by analysts. Due to some

shift in revenues from Q3 to Q4, the next quarter will probably show a

loss; analysts expect this to be 11 cents per share. While this year the

company will probably not make a profit, next year analysts expect a

better profitability, at 37 cents per share.

That

values the company at some 13x next year's earnings, which could be

considered a little steep for the industry. However, we think these

figures are not terribly important. For starters, the last four quarters

all contained significant positive surprises. More importantly, the

industry will rebalance, SunPower will be one of the survivors of the

shake-out, and the future looks a lot brighter. When prices stabilize,

profitability can be ramped up pretty fast. And that moment is coming

ever nearer.

In Summary

The company has quite a lot going for it:

The company has quite a lot going for it:

- It has a favorable geographical mix.

- It is a proven product leader.

- Its balance sheet, liquidity, profitability and gross margins are industry bests.

- Having a 'sugar daddy' in the form of Total to help keep it going through the rough time is pretty useful.

Price

falls and innovative financing are opening up solar energy to a much

wider clientele, and with industry consolidation in full force, there is

light at the end of the tunnel. If we could point to a weakness, it is

that their presence in China, which is set to become the largest solar market in the coming years, is quite weak.

There

are likely to be one or two more dips and we think that in the medium

and especially the long-term, these dips will prove to have been

excellent buying opportunities.