Founder, S&A Investment Research

INSIDE: The Secret Plan to Retain Power Through 2020

I know Obama will become the greatest president in U.S. history. Much like Kennedy, this has something to do with his charisma – which I find revolting, but others clearly love. However, that's not the real reason…

No, a simple secret lies behind Obama's soaring power, which is still far from its peak.

Even as I write these words, an enormous economic force is building. It is a force that rivals the scope of every single American boom in our history – from the 1880s steel and railroad boom, to the 1920s automobile boom, to the baby boom of the 1960s and the computer boom of the '80s and '90s…

The force now behind Obama is more powerful than all of these events – combined.

This force will carry Obama back to the presidency in 2012. And yet again in 2016. It's this force that will carry him into the history books…

This new economic force will change everything about the way our country's economy works. It will also reshape the world's monetary flows… for at least the next 50 years.

It will make millions of Americans vastly wealthier… and improve the standard of living across our entire nation.

But, in the process, I believe it will also make an idol of Mr. Obama…

It will give him an unprecedented public mandate. He will use this power to reshape our country… and to redraw the rules that govern the presidency. He will seek unlimited power.

I've written you this letter to explain this new force in our economy. And to warn you about how Mr. Obama will try to use this new power and his new popularity during his next administration. The next four years will be a time of tremendous change and opportunity… but also a time of tremendous risks to the liberties we all hold dear.

Very little stands between us… and a tyrant unlike any other in American history…

My name, by the way is Porter Stansberry.

Almost 15 years ago I founded Stansberry & Associates Investment Research. It has become one of the largest and most recognized investment research companies in the world, serving hundreds of thousands of subscribers in more than 120 countries.

I've made a lot of controversial predictions in the past – and they were right.

For example, I warned investors about Wall Street's collapse in 2008. I predicted the bankruptcy of both Fannie Mae and Freddie Mac. I also warned about the collapse of Lehman Brothers. I even predicted the bankruptcy of General Motors – as early as 2007.

Over many years, I've helped my subscribers profit from the dangers and the machinations of Wall Street's manipulators. To my knowledge, no other research firm in the world can match our record of correctly predicting the catastrophe that occurred in 2008. But for us, that's all old news.

What's happening now is far more important…

I'm writing to share with you the things I've learned about a massive change that's underway, right now, in the United States. I believe these new economic forces will reshape the economies of the United States and the world.

These things will change the political climate here and abroad. These new forces will increase the wealth of the United States and improve our standing in the world economy, but… in the process… they will also empower the president of the United States… perhaps enabling him to implement the most terrifying socialist policies in the history of our country.

Although I'm writing this letter before the 2012 election, I already know Obama will be re-elected to a second term. I'm certain he, or at least his proxy, will also be re-elected again in 2016, for a nearly unprecedented third term.

Using vast new powers, I believe Obama will:

- Greatly increase the size of the Fed's quantitative easing, leading to massive increases to inflation.

- Seize control of the entire 401k retirement system, forcing Americans to buy more of our government's risky debt.

- Implement vast new taxes across our economy, as they have already done with the health care program and which they will do next by implementing a national sales tax.

- Continue to expand the welfare rolls by record amounts, buying still more votes, more power and setting the stage for a third Obama term (something I'll explain in this letter.)

- Reshape our foreign policy, drawing America into partnerships with dictators and socialists around the world.

And please understand, I don't want to see the president gain enormous new powers, but that's what's going to happen, too.

I've written this letter, at least in part, as an attempt to stop what I now see is almost inevitable…

Unfortunately, I don't believe Obama can be stopped. Too much power stands behind him. What I can do, however, is show you how to prepare (and even prosper) from these same massive economic forces.

If our roles were reversed and you had something of value to tell me… something that could have vast influence on my life… what would you do? Would you tell me about it? Would you tell me even if I thought it was bad news? Even if it was a bitter pill to swallow?

I hope you would. And that's why I've written this letter.

In short, I believe Barack Obama will go down in the history books as one of the most powerful presidents of all time. I believe his administration will be extended into a third… and possibly even a fourth term, setting him up to become the most powerful president in history... a rival to Franklin Delano Roosevelt.

Ironically… the massive new economic power at Obama's disposal has nothing to do with politics – nothing at all. In fact, what's happening right now doesn't have much to do with Obama's policies at all.

As I'll prove to you in the next few minutes – he's simply in the right place at the right time.

But I know… he's a great opportunist. He will take these events and craft them into his own vision. He will use these massive new economic powers to transform America into a modern socialist state…

Here's how I believe it will happen…

In 2015, during Obama's second term, a specific event will take place that will change the course of history in the United States.

It has to do with an unstoppable development that's underway now. This event will usher in a new age of American prosperity, the likes of which we haven't seen in decades. In fact, this upcoming event is nearly identical to events that happened in 1901 and 1930. Most Americans have forgotten how powerful these events can be. Most Americans would tell you that events like these can't happen anymore…

But they can.

They are happening right now. They create tremendous prosperity. But they also create dangerous amounts of centralized political power… political power that feeds the dynastic ambitions of mad men…

My guess is that, as you read this letter... you'll say: " There's no way this could really happen... Not here."

But just remember:

No one believed me four years ago when I said the world's largest mortgage bankers – Fannie Mae and Freddie Mac – would soon go bankrupt.

And no one believed me when I said GM would soon be bankrupt as well... or that the same would happen to General Growth Properties (the biggest owner of mall properties in America).

But again, that's exactly what happened.

I've spent three years of my life studying these new events. At first, like you, I didn't believe it was possible. But... after spending more than $100,000 on this research and after spending month after month researching this topic, I'm now certain it real.

It's going to change everything about the way America works. Most of the changes will be tremendously positive. But there's a huge political risk to what's happening… and you deserve to know about it, the good and the bad.

I'm talking about the oil and natural gas boom that's occurring right now in America.

You see, it has been decades since America witnessed a bona fide oil boom.

Most people won't recognize what's happening today – because they've never seen anything like it. They won't understand how this will change politics in America. They won't understand how it will change our economy.

That's why… to know what's going on today… we first have to take you back in time…

WHAT A REAL OIL BOOM LOOKS LIKE

It's 1901.

Most of the world still lives in darkness. Kerosene, for lighting, is still a luxury. That's why you bought, “The Big Hill” in Texas.

It's a huge salt dome. Locals say there's no oil in it -- or in the dozens of salt dimples just like it that dot the Texas landscape.

Drilling was very difficult at first due to very little rock and several hundred feet of sand. This made the hole prone to caving in. Curt Hamill, one of your drillers, came up with a revolutionary solution to the problem. Instead of pumping water down the hole to remove the sand and rock, he used mud. The mud stuck to the sides of the hole and prevented it from caving in.

On January 10th, 1901, a blast of natural gas followed by a towering geyser of greenish-black crude shot up more than 150 feet out of the derrick… you hit pay dirt -- The Lucas No. 1 Well. It produced more than 100,000 barrels of oil per day – more than all of the other wells in the United States, combined. So many wells were drilled around it, they called it “Spindletop.” And since that day in 1901, mud has been used in almost every drill hole around the world.

In fact, so much oil flowed out of Spindletop the price of oil fell to three cents a barrel. The economic impact was unprecedented. The world's navies switched from coal to oil. So did the railroads. And Spindletop fueled a revolution in transportation, making gasoline cheap and widely available. In 1900, there were only 8,000 cars in America. By 1916, there were 3.5 million.

The wealth created during this oil boom imbued Americans with a new sense of destiny and power. They responded to a demagogue uniquely suited to capture their imagination. Fresh from his exaggerated triumphs in the Spanish-American war, Teddy Roosevelt seemed to be the picture of America's new strength. He was a cowboy. He was a roughrider. Americans loved him…

Ironically, Teddy Roosevelt used this massive new political power to attack the very institutions that created America's sudden prosperity. He helped pass law after law attacking large oil companies, like Standard Oil, for example.

The Standard Oil Company has, largely by unfair or unlawful methods, crushed out home competition... It is highly desirable that an element of competition should be introduced by the passage of some such laws… – Theodore Roosevelt, May 4, 1906

He lobbied Congress to pass the Hepburn Act, which for the first time gave the federal government the right to set maximum railroad rates and prevented railroad owners from giving “free rides” to their friends and supporters. He created the Food and Drug Administration to oversee food safety. He created the Department of Commerce to aid unions.

His most radical ideas were known as the “Square Deal.” His plan called for the imposition of an income tax (something that during his presidency was still barred by the U.S. Constitution.) The “square deal” might sound familiar to you. Similar political programs were offered by every Democratic candidate for decades. FDR's program was called the “New Deal.” Harry Truman's was called “the Fair Deal.” Lyndon Johnson's was called ‘The Great Society.' All of these programs were designed to give more power to the government… to increase taxes on the “rich”… and to redistribute the income or the benefits according to political patronage. This is just socialism dressed up to sell to Americans.

It's the exact same rhetoric you hear today from Obama.

Now, whether or not you think these so-called progressive policies are good or bad is a political question. It's a matter of opinion. It probably depends on where you sit financially. If you don't pay taxes, you probably love these ideas. If you do pay taxes, you probably resent them.

But whatever your politics, just consider this: Teddy Roosevelt was elected as a conservative Republican. His own party stood against his progressive ideas. Nevertheless, powered by a huge oil discovery – Spindletop – and a booming economy, the people of the United States began to demand their government do more and more things. Our sudden wealth and prosperity changed the political mood in the country. We were now rich enough to do more… to help more people. And the government, thanks to its oil riches, could now take on big business and win.

It's hard to believe how popular these views became… and how they transformed Teddy Roosevelt's presidency. He became almost a mythical figure… the most popular sitting president the U.S. had ever seen. He was, in a way, more like a European dictator than a U.S. statesman. This power would eventually lead him to run for a third term – something that had never been done before – in 1912.

But by then, most of his ideas had already been taken over by the Democrats, whose candidate Woodrow Wilson, would go on to become the most liberal president the country had ever seen. He changed the Constitution to pass an income tax. He set up the Federal Reserve and moved America towards paper money. He implemented the direct election of U.S. senators, transforming America from a limited republic to a democracy. And ignoring the advice and the precedence set by George Washington and our other founders, Wilson sent our troops to fight in one of Europe's endless wars. He claimed, preposterously, that World War I would make the world safe for democracy. (Americans have been dying for that same impossible goal ever since.)

Just imagine what Teddy Roosevelt might have accomplished if, like Wilson, he'd been a Democrat.... or if he'd merely run for office in 1908, instead of letting Taft (his hand-picked successor) take office. It's realistic to believe Teddy could have won the presidency at least three times… just as his cousin Franklin Delano Roosevelt would do beginning in 1932. But… the key point to consider is… where did this power come from? Why did Americans suddenly embrace a massively more powerful government, led by a charismatic demagogue?

The answer is, of course, oil.

The oil Spindletop produced changed the entire world – forever. The massive increases in production dramatically lowered prices for oil around the world, enriching the lives of millions of consumers. Americans who backed Spindletop became some of the richest people in the world. Gulf Oil, Texaco, Amoco, and Humble Oil all trace their origins back to Spindletop.

With this incredible wealth came hubris, great ambitions, and political power. It was an oil boom that created Teddy's Roosevelt's prosperity and his political power. And it was an oil boom that created his cousin's too…

Let me show you.

It's 1930.

You've just sat down at a backyard poker game, hosted by a Texas gambling legend – H.L. Hunt. As he rakes in the big pots, he begins telling you about his new oil deal…

We imagine he would have said something like this: “There's this poor son-of-bitch down in East Texas, Columbus Marion Joiner… he's sitting on the biggest oil field anyone has ever seen. But wouldn't ya know it… he's plumb out of money and he's got widows that invested with him all over the state. He slept with most of them too… that's why they call him ‘Dad Joiner.' I'm gonna take the whole field away from him, for almost nothin' – the poor fool.”

Whatever was said, exactly, the fact is, H.L. Hunt offered to pay Joiner $30,000 up front and $1.3 million through production – if any oil was ever found. Joiner was relieved of his legal troubles with the widows and told Hunt, “Boy, I hope you make fifty million dollars.”

It's a true story. Hunt bought the greatest oil field in U.S. history, without using a cent of his own money. All of the upfront funds came from his gambling friends. Over the next 50 years, the East Texas field would produce four billion barrels of oil, making Hunt one of the richest men in the world.

Although many historians credit the New Deal FDR implemented for accelerating the recovery from the Great Depression… that's looking at history through the lens backwards. What really happened is clear: The East Texas field created a tremendous amount of wealth. In the short term, lower oil prices caused a wave of economic disruption. But in the long term, it provided FDR with an immense amount of power… allowing him to launch one socialist scheme after another… to the overwhelming applause of the electorate.

People who believe that Americans don't want socialism haven't studied presidential politics. No other president did more to build up the “social safety net” in America than FDR. He launched Social Security. He launched government's efforts to provide mortgage loans. He seized all of the privately owned gold in the country – just so he could massively devalue the U.S. dollar. He set up government-led scheme after scheme to grab more control of the economy. There was a veritable alphabet soup of new federal agencies – more than 30 of them. The CCC, the NRA, TVA, FCC, NLRA, FHA, FDIC, PWA, etc. The agencies were created to reward his backers… to punish his foes… and to buy votes by the millions.

How did America react? They re-elected FDR three times, making him the only president in history (for now) to serve more than two consecutive terms.

Whether you like it or not… presidents who can garner the most economic power end up achieving the most political power. And… at least for the last 150 years… the root of modern economic power comes from the world's oilfields.

So… how will Obama grab enough political power to re-write the U.S. Constitution and run for yet another term? Simple: I believe he'll launch social spending program after social spending program. He will oversee the largest expansion of the welfare state in the history of our country. He'll launch new federal departments (something he's already done… but will expand). He'll enrich thousands of his backers… and impoverish his enemies… all a scale never seen before in American history.

How will all of this be possible? Oil. More oil than has ever been found before…

Here's the simplest way to understand it…

East Texas was the largest oilfield ever developed in the continental U.S. It has produced around 4 billion barrels. It is thought to hold total reserves of between 10 billion and 20 billion barrels. This field, alone, was big enough to help win World War II and to transform America's economy in the '40s, '50s, and '60s – making us the greatest economic and military power in history. FDR, grabbing this power, nearly transformed America into a socialist totalitarian state. And he did so with the crowds cheering his every move.

Today, in the United States, oil companies have recently found more than 20 different shale fields that contain more than 20 billion barrels of recoverable oil each. These fields are all larger than East Texas. Each one of them…

This new oil shale boom is the biggest revolution to the energy sector the world has seen since Spindletop or since East Texas began production. These new gushers are bigger – far bigger – than anything in the history of the oil business in the U.S. They're like finding 20 new Persian Gulf fields… right here in America.

You don't have to take my word for it. That's exactly what the world's leading expert on new oilfields, Dr. Leonardo Maugeri, said about America's shale bounty. “The natural endowment of the initial American shale play, Bakken/Three Forks in North Dakota and Montana could become a big Persian Gulf producing country within the U.S. But the country has more than 20 big shale formations…”

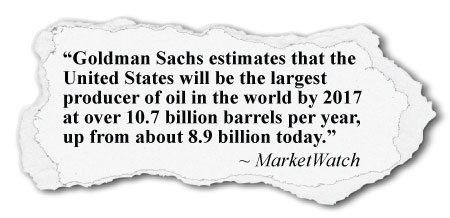

That's why Goldman Sachs, the most dominant investment bank in the world, is now predicting that America – the good ole U.S. of A. – will outpace Saudi Arabia in oil production before the end of this decade.

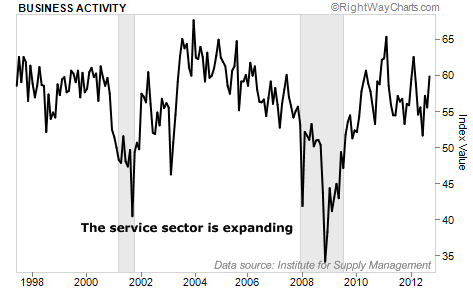

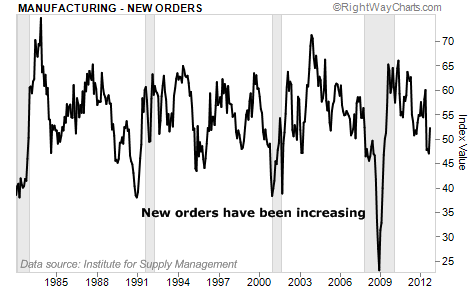

Most people still don't know that an oil boom is happening right now. The technologies that led to the natural gas glut between 2008 and 2012 have been put to work in oilfields across the U.S. The resulting oil boom, underway right now, will become the greatest creation of wealth in America's history.

This report is about exactly how that's happening. You'll find the names of the companies involved, the histories of the entrepreneurs… and perhaps most importantly of all… the strategies that you'll need to capitalize on these changes.

Thousands of people have already gotten rich… but the biggest gains are still to come. With the details you'll find in these pages, you could literally make a fortune in oil and gas over the next few months, as a few of my friends have already done.

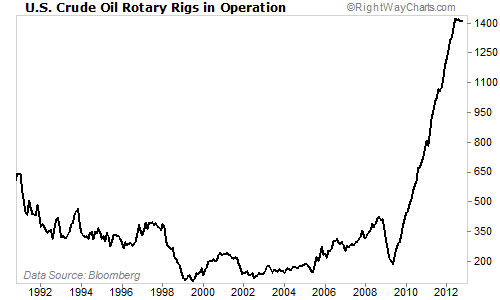

You see, new major oil reserves are being discovered faster now than ever before in American history. Thousands of new drilling rigs are being put to work, along with hundreds of thousands of Americans. The size of America's proven reserves of oil (not just natural gas) are poised to soar.

To give you some idea about the scope of these discoveries, consider that the total proven oil reserves in the United States today stand at 21 billion barrels. But in each of the major oil shale plays we're following, our sources tell us that there are more than 20 billion barrels of oil. Harold Hamm, for example, who is the CEO of Continental Resources, says there's 24 billion barrels of oil in North Dakota's Bakken formation. He would know. He's drilled more oil wells up there than anyone else.

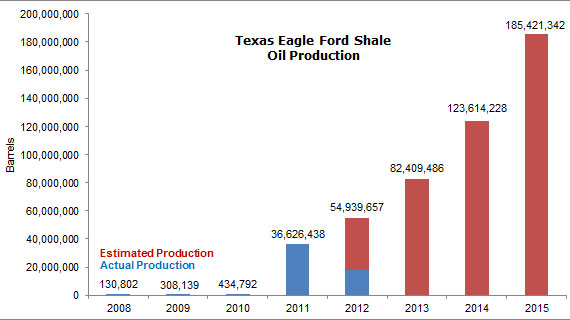

Likewise, experts we follow have made similar claims about the Eagle Ford shale in Texas, where oil production is already soaring. It's hard to believe how much oil is coming out of the ground now in Texas, unless you've seen it for yourself. But… here's a taste of the boom that's coming. Oil production in the Eagle Ford was 4.3 million barrels during 2010. Just one year later it was almost 10 times more – 36.6 million barrels. By the end of 2012, that figure will certainly be over 50 million barrels, and this rate of growth is going to continue for a long time.

Over the next several years drilling and production will prove out these new shale fields. As that happens, America's proven reserves of oil will soar, from only 21 billion barrels to more than 100 billion barrels, making America the world's leading oil producer.

I realize… this all might be hard for you to believe, at first. It probably contradicts everything you've been told in the past about U.S. and global oil supplies. But I guarantee you, no one has done more work on this subject than we have. These discoveries are real. Production is already soaring. And shale will change everything about the oil business.

It will also change everything you think you know about U.S. politics…

THE NEW REALITY OF OIL AND POLITICS IN AMERICA

Far from being energy dependent, America is already a net energy exporter again.

It's true. For the first time since the 1940s, the U.S. is exporting more refined petrochemical products than we're importing oil.

That's mainly because we're now able to produce natural gas so cheaply that the entire global chemical industry is re-locating here. For example, Bloomberg recently reported that Dow Chemical Co., the second-largest chemical manufacturer in the world, “spent a decade moving chemical production to the Middle East and Asia. Now it's leading the biggest expansion ever seen back home in the U.S. as shale gas revives the industry's economics.”

John Deutch, MIT professor and former CIA director who last year chaired a Department of Energy subcommittee on natural gas, says, "In my 50 years of following the energy business, this is by far the biggest event that I've seen."

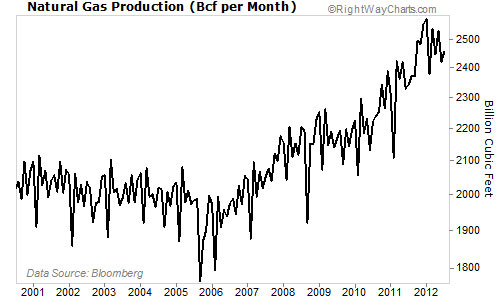

As I said, this new export-led chemical boom is being caused by record amounts of U.S. natural gas production. In 2011, the U.S. saw a new all-time high amount of natural gas production. Rather than running out of fossil fuels, we're now “drowning” in them. Prices, naturally, have fallen to decade lows in response to the massive increases in natural gas supply.

The exact same thing will happen next to oil.

The same technologies, horizontal drilling and hydraulic fracking, are now at work in the new oil shale fields. Yes, these technologies were pioneered by gas companies, which is why gas production soared first. But they were also put to work in oilfields starting about two years ago. As a result, oil production is beginning to increase, and the downswing of prices has begun.

Most investors simply don't understand how this process of wealth creation works. Nor do they understand the political implications…

Low prices will lead to vast new markets for our oil and gas all over the world. It will create hundreds of billions in profits, annually, for American oil and gas firms. It will lead to huge capital gains for investors. It will cause massive new investments in infrastructure – like pipelines and refineries.

All of this new wealth, all of this new growth… will seem like a gift from the prophet Mohammed to the administration of Barack Obama…

At every stage in the process, there will be licensing and regulation from his administration. He'll have the chance to pick winners and losers… and to make every producer, every toolmaker, every infrastructure builder pay a tax to his administration. Everyone who touches these vast new fields, everyone involved in these new technologies, will have to get something from Washington – some kind of license or approval. And they will all pay. Billions and billions and billions will go to D.C.

This incredible source of wealth will create so much political patronage and so much power that Obama, even with all of his robust socialist dreams, even with his desire to “spread the wealth around” won't be able to spend it all in a single term…

No… as this money comes pouring in, you will see his administration turn drilling rights and other key approvals into virtual shakedowns. They will get paid. And they will convert this power into a new kind of American socialism. Just like Hugo Chavez has done with Venezuela's oil riches, I believe Obama will take America's natural bounty and convert it into a giant political slush fund.

Soon, you'll see the crowds out cheering for him… and demanding a third term.

What can you do about it?

I'd suggest making your own profits from the oil pool. And I'd suggest doing it now, before Obama gets his grimy hands on it.

IT'S NOT A QUESTION OF IF BUT HOW SOON?

The first thing you have to realize about this shale development is the sheer size of the trend.

As we mentioned, Goldman Sachs is predicting the United States will be the leading producer of oil in the world by 2017. It sees American oil production reaching 10.9 million barrels a day by 2017. That's more production than Russia and Saudi Arabia. And U.S. production at those rates would eclipse the previous all-time high daily production in the U.S., which was set in the early 1970s at nearly 10 million barrels per day.

Most people believed this could never happen… that we'd already reached “peak oil” and that production rates would only fall, forever.

But those predictions were simply wrong. Once again, new technologies, daring entrepreneurs and billions in investment capital have changed everything in the oil business.

Amy Myers Jaffe, energy expert and director of the Baker Institute Energy Forum at Rice University, summarizes the information we have now:

“ By the 2020s, the capital energy will likely have shifted back to the Western Hemisphere,” due to both the stable political environment and of course the new technologies of horizontal drilling and fracking.

There's also Pete Stark, a former geologist for Mobil Oil, who agrees, “ A huge production revival through 2020 with tight oil leading the way.” He dubs this the age of the “tight oil renaissance.”

This news of energy independence couldn't come at a better time.

Our currency has been in dire jeopardy. Unrest in the Middle East has caused soaring oil prices and has put pressure on the U.S. dollar as reflected in huge U.S. trade deficits. Last year alone, petroleum accounted for 44% of America's trade deficit.

As Edward Morse, former U.S. diplomat and now global head of commodities research at Citigroup says, “ The two vulnerabilities of the U.S. as a global superpower have been its dependence on imported oil and its current account deficit. Now it may be in the process of resolving both of those.”

Obviously, that's great news for our country, as Mr. Morse explains: “ The notion that the U.S. was a superpower in the 20th century but won't be in the 21st doesn't hold up so well now…. Compare us to a country such as China, which is going to be overwhelmingly dependent on energy imports. The U.S. is in a much stronger position.”

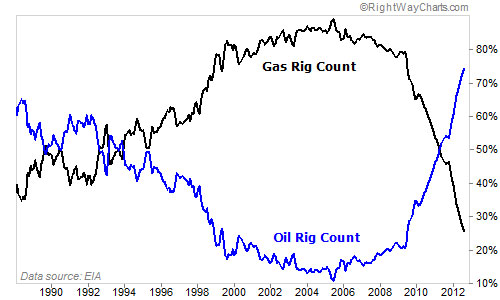

Take a look at this chart to understand the trend that's occurring in the U.S.:

As you can see, there's a sharp increase – an unprecedented increase – in U.S. crude oil drilling rigs in operation. And that means, an unprecedented increase in U.S. supply is around the corner. Remember, the U.S. is still in its infancy for shale drilling. There's still a huge shortage of drill rig supplies and fracking crews. If you doubt any of the things we've told you so far… just look at that chart again.

If you take only one idea from this letter… if you walk away with only one idea to use in your own investing, let it be this: We have a road map for the coming changes to the oil market. All of these things have already happened with natural gas.

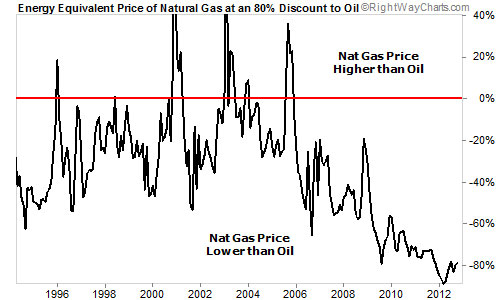

The natural gas drilling boom began about 10 years before the oil boom. Prices for natural gas, as you know, collapsed in 2008. They haven't really bounced back yet.

Most people think the collapse in natural gas prices will last forever. They're wrong. Natural gas is being sold at prices that defy all logic based on history and its relationship to other forms of energy. Historically, natural gas has sold for about 1/10th the price of oil. In the U.S. today, it's trading for over 1/20th the price. This huge price discrepancy will resolve itself soon. When it does, billions of dollars will be made.

Let me show you what I mean in two ways.

First, this chart shows the relative prices of West Texas Intermediate (WTI) crude oil and U.S. natural gas based on energy equivalence. As you can see, buying energy in the form of natural gas is now 80% cheaper than buying oil. That's a record-breaking difference. That means, wherever possible, energy buyers are going to prefer natural gas.

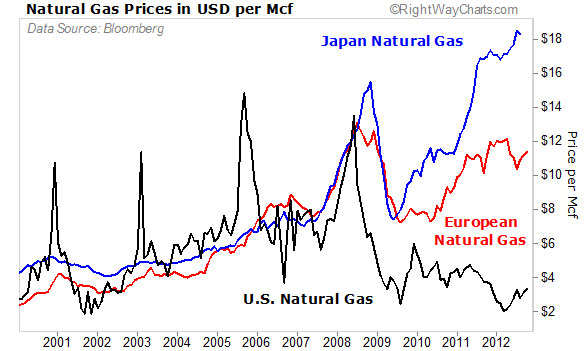

Here's the other key chart. It shows how gas prices have diverged substantially for the world's major markets – U.S., Europe, and Asia.

Today in Asia, natural gas is still selling for more than $17 per thousand cubic feet (mcf), while the price in the U.S. is still down around $4 per mcf.

Economics dictates that these huge price discrepancies for a commodity – like energy – shouldn't exist. Normally, energy prices in the world's major markets are close to the same. That's because the supplies of these commodities are normally roughly the same.

But something changed in the mid-2000s with natural gas. And now you know what happened: Fracking and horizontal drilling unleashed a tidal wave of new supply in the U.S. These supplies couldn't reach foreign markets, because the U.S. doesn't have the infrastructure in place to export natural gas… at least not yet. The result was a huge glut of natural gas in the U.S. market. The price of natural gas in the U.S. collapsed.

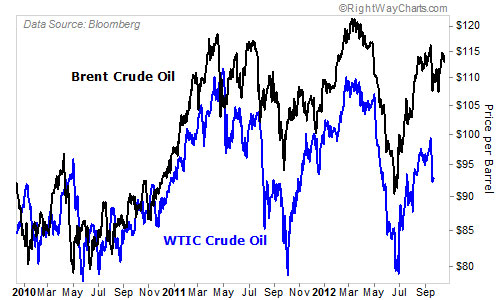

The same thing is happening today, right now, with oil. Prices for domestic WTI oil have “de-linked” from international prices (called “Brent crude”).

This shows that oil is now much cheaper in the U.S. than it is in the rest of the world. That's a startling development. That hasn't happened in more than 40 years. And just as international price discrepancies foreshadowed a glut of natural gas, supplies of oil are building in the U.S. market to record levels.

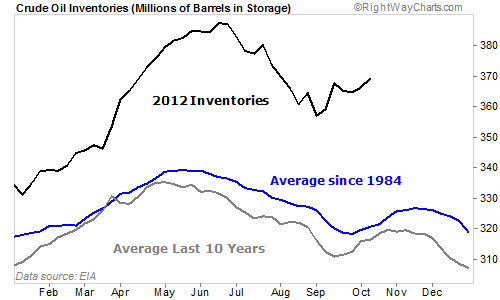

In June 2012, according to the U.S. Energy Information Agency, U.S. crude oil inventories hit an all-time high for that month. Furthermore, crude oil inventories have almost never been larger since 1983, which was just before the historic collapse in oil prices that saw gas selling for $0.55 per gallon.

You can look at the inventory chart yourself… I've never seen anything like this before:

This is another sign – perhaps the best yet – that the shale oil boom is real. America's surging oil production is going to change everything we think we know about energy.

Right now, the price of natural gas in the U.S. is roughly 75% cheaper than the international price. Such a dramatic difference in price in the same commodity – energy – won't exist for long. Likewise, the huge discrepancy between the price of energy in the form of natural gas compared to energy in the form of oil won't last for long either.

Two things are happening, which will cause prices for energy to equalize.

First, traders will find ways to export U.S. natural gas, moving supplies into foreign countries where the price is higher. And secondly, domestic consumers of energy will shift from using expensive sources (like diesel and coal) to vastly cheaper sources, like natural gas.

That's exactly what's happening – right now – with the U.S.'s biggest energy consumers.

They're making the switch from diesel to natural gas right now in America. Take Waste Management, for example. It is North America's largest commercial waste company. It recently added its 1,000th natural gas truck to its fleet last summer. It is committed to converting its entire fleet of 18,000 trucks from diesel to natural gas.

For every truck that's converted to natural gas, an average of 8,000 gallons of diesel fuel will be saved a year per vehicle. That's a savings of over $19,000 in savings per truck. You don't need a mandate from Congress to make these kinds of changes when the economics are so compelling. And so, as you'd expect, Waste Management isn't the only big company making the switch. Wal-Mart, AT&T, United Parcel Service, FedEx, PepsiCo, and Verizon are just a handful of the names converting.

Eric Marsh, executive vice president for Encana (leading North American energy producer) says, “ Today, there are more than 12 million natural gas vehicles worldwide but less than 1% of them are in North America. Yet our continent has the most to gain, economically and environmentally from fueling its vehicles with natural gas.”

Replacing 3.5 million heavy-duty vehicles with natural gas would save more than 1.2 million barrels of oil per day. This is more than the U.S. imported from either Venezuela or Saudi Arabia in 2009.

Here's what T. Boone Pickens has to say. I'm sure you know his name. The legendary oilman and investor has probably been the most outspoken advocate for natural gas over the past decade. He knows what's happening with shale production is real. It's the biggest change in the energy market he's ever seen.

“ I've been in the energy business my entire career and I can assure you this 81-year-old has chased down more deals than anyone you'll ever meet. A lot of those deals didn't pan out -- that's just how the game is played – but every now and then a big kahuna comes along. When it does, you'd better jump on it. Right now… that sort of game changer has landed right in our lap.”

For the first time in 16 years, U.S. oil rigs now outnumber natural gas rigs. Take a look at the chart below.

In 2005, just 11% of the drill rigs in North American were drilling for oil. But today, it's more than 75%.

My friends… this isn't rocket science. Less drilling for gas means less gas… just as demand for gas is soaring. Power plants are converting to natural gas from coal. Trucking companies are moving from diesel to natural gas, too. And consumers of every variety are substituting natural gas for electricity everywhere they can – like putting natural gas dryers in their homes, instead of electric.

Very soon, there will be a supply/demand shortage. And that means the price of natural gas will start to go up.

There's another, even more important reason natural gas prices are going to go up.

Beginning in 2015, the first large-scale natural gas export facilities are scheduled to open on the Texas coast. I believe by the end of 2016, the U.S. will be among the world's largest suppliers of natural gas, around the world.

Imagine the boost this will give to Obama's second administration. By the end of 2015, America will be the Saudi Arabia of natural gas. We will dominate the global market for natural gas. Obama will be able to pick and choose which of our allies get our natural gas… and how much they have to pay.

Do you think he'll support Israel? Or maybe lend a hand to his friends in Cuba?

Whomever he picks, one thing is certain: Having this much oil and natural gas will make his administration the most powerful America has ever seen. Who knows what he might do?

One thing we're certain he will do is run for a third term…

Whether by changing the Constitution or by simply running his wife, Michele, in his place we can't predict. We only know Obama will never give up the amount of power he will garner in his second term. Look at his entire career. Obama has never shied away from taking power… or taking credit. Like any good Chicago politician, he knows how to use influence. He will capitalize on this energy revolution to become the most powerful president in modern history. Like other energy-backed demagogues around the world (Putin, Chavez, the Kirstners in Argentina), he will not willingly give up his power.

He will use oil and natural gas to transform America into a modern petro-socialist state. And he will use oil to stay in power… for as long as possible…

These predictions might surprise you. But when this comes to pass, what will shock you is how millions of Americans will applaud these changes. Your neighbors don't want freedom. They don't want lower taxes. They don't want more opportunity.

You know what they want? More handouts.

They want their president telling other people what to do, all over the world… just because he'll create the illusion that he's helping them. Like with his cell phone giveaways and his mortgage reduction schemes, he'll continue to punish and tax those who work hard. Just like the Roosevelts, he will excoriate and attack the people and the companies who have created the oil riches… just to win the public's approval. And then, he will use those same resources to buy favors and luxuries for millions of Americans… people who have done nothing to earn it. This will create more and more political dependence… more and more corruption… more and more socialism…. and the crowds will love him for it.

No one cheers more for a tyrant than those he enslaves. And so it will be in 2016, when the crowd will demand yet another Obama presidency.

These are changes that very few people understand… changes that are inevitable… and that are underway right now.

In some ways, these changes are unbelievably good. Investors, for example, who buy natural gas assets now, while prices are still incredibly low, will likely make an absolute fortune in the years to come.

But some of these changes are bad… very bad…. And they're very dangerous to people like me (and perhaps like you) who value their freedom, who value the tradition of limited government… who value the traditional American ethos of fair play and hard work.

There's nothing much I can do about the mad lust for power we're about to see unleashed in the White House. I can warn you about it, and that's about it. There's no way we can hope to outvote the masses… especially not when more Americans than ever before are already on the government dole and nearly half of America pay no income taxes at all.

The only way I can really help you is to show you how these massive economic changes are happening… and how to position yourself to profit from them. Let's start with the safest ways to profit from this boom. I'm talking about the absolute cannot-miss bets to make.

FOUR WAYS OF MAKING A KILLING IN THIS BOOM – WITHOUT TAKING BIG RISKS

There's a very stupid way to invest in the oil and natural gas boom.

This is probably how your neighbors and friends will do it. They will hear about a big new oilfield (maybe like the secret one we'll tell you about below), and they'll buy shares of the company that's exploring it.

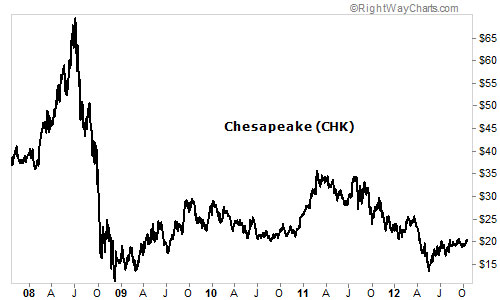

Think about how this worked out for shareholders of Chesapeake during the natural gas boom. Remember, the natural gas boom is like our playbook for what's about to happen with oil. What you can see is, even though Chesapeake came from nothing to be the second-largest producer of natural gas in the U.S. (behind ExxonMobil), its share price got killed when the price of natural gas fell in 2012 and the company's finances were revealed to be weak.

And that's what you've got to watch out for with the oil boom. Production rates at small oil companies in the U.S. are going to soar. There will be lots of buyouts and takeovers. But… as production ramps up… the price of oil is going to fall. That's great for America's consumers (and the president)… but terrible for oil investors. You have to be very careful.

We believe there are four proven, incredibly safe ways to make huge gains on the oil boom. They all involve either buying the “tools and shovels” of the boom – things that aren't directly related to the price of oil – or even better, finding a way to buy the energy assets themselves at very discounted prices.

Let me show you exactly what to do.

First, the very best way, I believe, to make a fortune in the ongoing energy boom is to invest in the infrastructure that must be built to move U.S. energy into global markets. This might sound boring at first. But believe me, some of the biggest gains in the history of the oil business came from the men who were smart enough to own the infrastructure required to get the oil and the gas to market.

To really understand what's going to happen, we have to go back in time again. Just once more…

It's now 1890.

Huge new oil fields have just been discovered in the Dutch East Indies (today's Indonesia and Papua New Guinea). These new resources offer a chance to challenge Standard Oil's grip on Europe's energy market. A British shell merchant, Marcus Samuel, has an idea. If he can find a way to get the oil from the Dutch East Indies into the European markets cheaply enough, he could take over the energy business in Europe.

All Samuel needs is access to the Suez Canal. Access would cutoff 4,000 miles of travel around Africa's Cape of Good Hope – and greatly reduce the cost of shipping the oil. Samuel partners with the powerful Rothschild family. They lobby the British government to allow specially designed oil tankers to transit the canal. Samuel commissions eight new tankers…

By the end of 1895, sixty-nine tanker passages had been through the Suez Canal. All but four ships were owned or chartered by Samuel. He was able to flood the market in Europe with cheap Dutch Indies oil. By 1902, Samuel still controlled 90% of the oil to pass through the Suez Canal.

Marcus Samuel and his small group of investors created one of the world's largest fortunes – a company now called Royal Dutch Shell. It's valued today at over $200 billion. Their wealth didn't come from discovering oil… it came from understanding the importance of transporting energy around the world to the markets offering the highest prices.

The exact same thing is happening today with a new form of energy called LNG.

To ship natural gas around the world, it has to be converted into a liquid form, something called liquefied natural gas, or “LNG.” Once converted into a liquid, natural gas can be shipped via tanker, much like oil. But… the big difference is LNG requires specialized, very expensive tanker ships. And it requires huge import and export terminals.

Building out these new ships and these new terminals will take at least a decade. And during that time, investors in the right assets will build huge fortunes…. Like the investors who are smart enough to buy LNG tankers today. The world's shipyards currently have more than 140 LNG vessels on order...

Luckily for regular, individual investors, a well-run company already owns one of the largest fleets of these highly specialized, expensive ships. It owns 27 ships, in fact, some of the largest in the world. It's engaged constantly in deals to acquire more ships, and it has dozens more on order. I'm certain this stock is going to soar over the next few years. And here's the best part: The company boasts a current yield of 7.1%.

Just imagine earning 7% in income… while you're building the most valuable collection of ships on Earth… all in a financial environment where you essentially earn nothing on your money in the bank.

Global demand for LNG is expected to increase by more than 50% over the next two decades. I think we'll see capital gains of 20%-30% per year in this company, in addition to the big annual dividend. It will be hard to make more money in any other safe investment.

In fact… I believe this shipping stock is one of the only “sure things” you can invest in today and make a bona fide fortune. What are the other sure things?

Just think about this for a minute. Right now, natural gas costs a lot more in Asia than it does in America – roughly 300% more. Like Marcus Samuel proved, investors can make a fortune by selling energy in foreign markets. To export American LNG, we need two things. First, we need boats, like the LNG tankers I mentioned above. Second, we need LNG export terminals in the U.S.

These terminals aren't easy to build. They're gigantic operations. The terminals must cool huge quantities of natural gas to minus 259 degrees Fahrenheit. Only at these incredibly cold temperatures does natural gas turn into liquid form.

Guess how many LNG export terminals are operating right now in the U.S.? None.

That's right. There aren't any. None. And of the eight terminals currently being constructed… only one has the necessary license from the U.S. government to export LNG. So… just imagine… there's an incredible glut of energy in America… and a huge demand for energy all around the world… but right now there's only one “toll bridge” that's operating between these two markets. And it's slated to begin operation in 2015, during Obama's second term.

While there's some competition (not much) for LNG tankers, there's no competition currently for the LNG export terminal owner. No one else has a license. That makes it, probably, the single best company to own in the entire world's energy complex today.

And just imagine what those other licenses must be worth to the companies that own “stranded” energy assets in the U.S.

Let me give you just one example. Exxon owns a LNG import facility in Texas. Here, the company has been importing natural gas from Qatar to the U.S. for many years. With America's new glut of natural gas, there's no need to import gas from Qatar. Instead, Exxon would like to reverse engineer the facility to export America's energy surplus to the rest of the world. The cost of the construction is estimated to be $10 billion.

The facility would allow Exxon to process 2 billion cubic feet of gas every day. The gas would be loaded onto waiting tanker ships and shipped to Asian markets. At $16 per mcf (current prices in Japan), that's energy worth $32 million per day. Over the course of a year, that's over $11 billion in energy. And all Exxon needs to begin collecting this money is a single license. There are no legitimate safety concerns, as the plant already operates as an import facility.

Guess who will decide if Exxon gets a license?

Mr. Obama.

Do you remember what one of Obama's mentors in Chicago – Illinois Governor Rod Blagojevich – said on a FBI wiretap about the opportunity to appoint someone to take over Obama's U.S. senate seat when Obama was elected president? He said of the senate seat, “ It's a fucking valuable thing, you just don't give it away for nothing.”

We're confident the Obama administration knows the same is true – but even more so – for these energy export licenses. They're worth tens of billions, each. And eight of them are waiting on Mr. Obama's desk. Do you wonder why they've been sitting there for up to a year now?

Already 44 congressman (including 10 democrats) have signed a letter urging the Obama administration proceed with the regulatory review and grant the licenses. But so far, Obama won't commit to any approval timeline.

We're not surprised. We believe the licenses will eventually be granted… but not until Obama's team has gotten its pound of flesh.

This is how the power of America's energy boom will be stolen by our president.

Thus, for now, and for the foreseeable future… the one company that has a license to export LNG will reap a fortune. Investors should buy the stock.

Finally… there's one more stock you ought to consider that's in the same line of work…

The build-out, around the world, of the infrastructure required to enable LNG distribution of natural gas will take a decade or more. All of those ships I mentioned they're building – the 140 new LNG tanker ships – they will all require import-export terminals, pipelines, storage tanks, etc. The U.S. is the world's largest market (today) for natural gas precisely because it has the best natural gas infrastructure. Our approach to energy will be copied, around the world.

And… this will require building vast amounts of new energy facilities.

One company specializes in LNG infrastructure. It's the world's leading LNG builder. It makes the terminals. It makes the pipelines. It makes the storage tanks. You won't be surprised to learn that this stock has already doubled in the last two years. But this is only the beginning. The rise in the stock so far doesn't even match the backlog of its business.

This is my second “sure thing” way to invest in America's energy boom. It's always safer to buy the companies that make the infrastructure than it is to buy the oil producers themselves. Or as we say around the office, someone has to make the barrels for all that oil. That's one of the great lessons I've learned as an investor… It's often the guys who make the barrels that earn the most money.

Everything you need to know about the only licensed LNG terminal company, the LNG shipping stock and the LNG construction company can be found in my new report, called: Cornering the World's Next Trillion-Dollar Business: LNG Shipping, LNG Terminals, and LNG Construction. And just so you know, I've been following the licensed terminal company for more than five years. As far as I know, there's not another investment analyst anywhere who knows more about the situation or who has been following it longer. You're not going to find this information anywhere else.

You might normally expect to pay $1,000 or more for this kind of information. Investors routinely pay huge sums for valuable investment research. But… I'll show you how to get my report, for free in just a minute.

First though, I want you to notice that I don't believe the best way to invest in this boom is simply buying the oil and gas producers' shares . There's a vastly better way to invest in these assets… and I'll explain it to you in this letter.

No matter how you buy these assets, you have to be prepared for extreme volatility. The prices of oil and gas have been extremely volatile over the past decade. They will be even more so over the next decade as the production companies try to balance bringing new supplies into the market against their production costs. This won't be easy. And it will be painful for many inexperienced investors.

That's why I'm going to urge you to invest in this boom in safer ways at first. And that's why I'm going to teach you a much better way to buy (and value) oil and gas assets. There's a good way to make all of the volatility pay off for you. But it's a little tricky.

So… first… let me tell you about the third, super-safe way, to make money on the energy boom.

Today, almost half of the electricity generated in the U.S. comes from coal-fired power plants.

Only 24% is generated with natural gas – at least for now. But the new abundance of natural gas – more than 100 years of supply – is creating a significant energy shift. The cheaper natural gas gets, the more of it we'll use and the more uses we will find.

Let's look at the other major sources of energy compared to natural gas. As you can see, gas is the cheapest. It's also a very clean burning fuel – much cleaner than coal.

| Fuel |

Cost per kilowatt hour to make electricity

|

| Natural gas |

$0.039-$0.044

|

| Coal |

$0.048-$0.055

|

| Hydro |

$0.05-$0.11

|

| Nuclear |

$0.11-$0.14

|

| Wind |

$0.04-$0.06

|

| Solar |

$0.15-$0.30

|

ExxonMobil believes natural gas consumption for electricity generation will rise 85% from 2005 – 2030. The U.S. Department of Energy expects 900 of the next 1,000 power plants built in the U.S. to be gas-fired. Natural-gas-fired electricity will become the affordable form of electricity in the United States. Demand for this kind of electricity will soar in the years ahead. What's the best, safest, “sure-fire” way to profit from this trend?