|

By Dr. David Eifrig |

| Wednesday, November 7, 2012 |

Ignore the fear. Our economy is grinding higher.

Over the last year, I've told you several times to ignore the "crisis and collapse" crowd.

You may be paralyzed by the negative stories that fill the news.

The European debt crisis is escalating. China is slowing. And people are

still worried about a U.S. recession. But if you're getting swept away

by fear, you're missing out on the chance to make safe profits.

If you take the time to cut through the hype and look at the facts,

you'll be able to take advantage of the opportunities that are out

there... And you'll see the economic story in the U.S. is slowly getting

better...

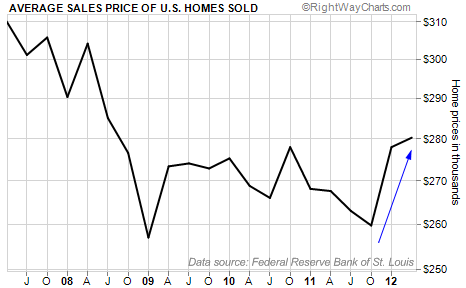

One indicator to watch is the average sales price of houses sold in the U.S.

During the housing bust in 2007, housing prices fell more than 20%.

Earlier this year, housing prices had a small correction (falling close

to recession prices), but they've steadily increased since.

Like my colleague Steve Sjuggerud,

I've been telling my readers this is a great time to buy a new home,

before prices start to rise higher. And this indicates housing

inventories that have been stagnant for years are finally moving. People

are buying homes and are able to afford higher prices, on average.

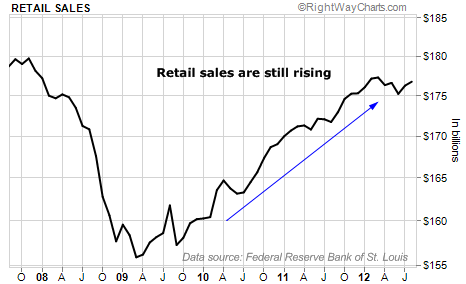

The trend is even stronger when you look at retail sales. U.S.

retail sales are strong and getting stronger. Except for the occasional

dip here and there, this chart has been climbing steadily since early

2009.

The economy is growing. Things are OK.

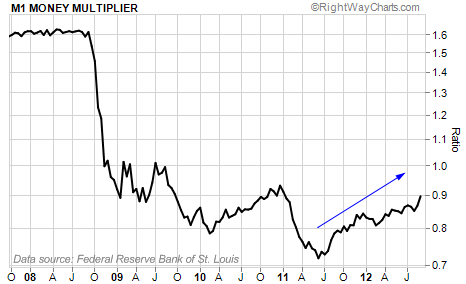

Importantly, while the economy is "grinding" higher, it hasn't gotten overheated...

The last chart I want to show you today is the Federal Reserve's

"M1 money multiplier." The M1 is a global sign of money inflation. It

measures the actual flow of money through the economy...

The M1 has been increasing slowly over the past two years... but it

remains below "1.0." So inflation should not be a big worry anytime

soon.

All these charts confirm what I've been saying over the past year: The U.S. economy isn't falling off a cliff.

The U.S. economy is keeping up a slow, steady pace of growth. If

things continue at this slow pace, we could enjoy a stable, "middle of

the economic-cycle" recovery for years.

That's why I still encourage readers to hold on to blue-chip, dividend-paying businesses

like Microsoft, McDonald's, and Wal-Mart. These provide safety, growth

potential, and stable income. I'm also going against the crowd and

recommending you hold on to municipal bonds.

Like fears about the U.S. economy, worries about municipal bonds are

overblown. These are still great income vehicles for retirees.

Sure... things may change. The government's bungling will likely

cause problems down the road. But the bottom line for you as an investor

or retiree is that we have little to worry about right now.

All you have to do is look at the facts to realize it.

If you're not aware of this evidence, or simply deny that it exists, you could miss out on huge investment opportunities over the coming years.

Today, I'm going to show you more evidence… and remind you why it's so important.

I keep writing about the state of the economy because most folks constantly hear how bad things are… But listening to all that will lead you into poorly performing investments.

You see, the facts show a different story…

The current market highs are good signs of coming better economic times. (The benchmark S&P 500 stock index is only about 10% off its all-time high.) But many people remain anxious that the ending of the Bush-era tax cuts and the automatic reductions in government spending will drive the market off a cliff.

The market will be fine… and here's why…

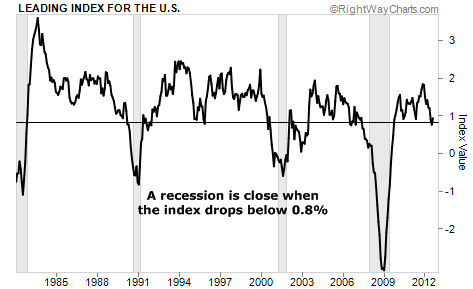

The Federal Reserve of Philadelphia publishes a chart called the "Leading Index." It combines data on things like housing permits, unemployment insurance claims, interest-rate spreads, and manufacturing surveys in an attempt to predict where the economy is headed.

When the index is above "0" and trending up, it presages growth. When the line falls and approaches "0" (or lower), the economy is slowing. Usually when a downtrending line crosses about 0.8… we're headed for a recession.

As you can see in the following chart… Since the middle of 2009, it's flirted with crossing the "0.8" recession-signaling threshold. But each time, we've bounced back. For now, it's consistent with a slow-grinding economy. We'll watch this closely for signs of deterioration.

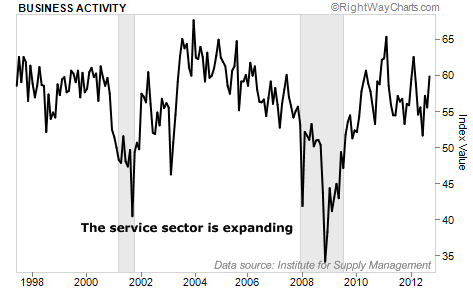

I also like to track activity in the service sector – which is almost two-thirds of the U.S. economy. The service sector consists of things like shipping, waste disposal, health care, and financial services.

The Institute of Supply Management trade association compiles a figure called "non-manufacturing business activity." When the number is above 50%, it indicates the service sector is expanding. As you can see from the graph, the latest point is almost at 60%, with sharp increases over the past several months.

For pundits predicting that the U.S. economy is heading for a big leg down… this is a surprise. At best, it suggests things (jobs, income, etc.) will keep improving over the next several months. At worst, it was just a summer spike driven by travelers – foreign and domestic – and will slow down this winter.

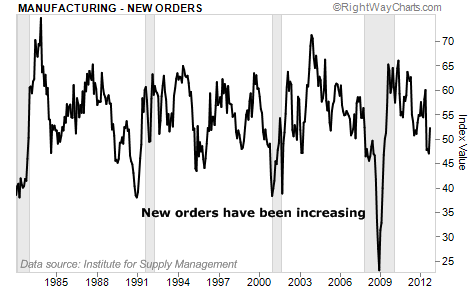

Similarly, the other part of the economy – manufacturing – has seen new orders increasing (when the number is above 50%) after having dropped below that level over the summer. The slowdown in China and South America is likely holding down this number. But I look for it to remain steady through the fall, as Europe recovers and America's economy chugs along.

This is all consistent with an economy that's chugging along in low gear.

As I said in October, it's possible that things will change. The government's bungling will likely cause big problems down the road. But the bottom line for you as an investor or retiree is that we have little to worry about right now.

So the right thing to do is stay invested in blue-chip, dividend-paying businesses like Microsoft and Chevron. I remain against the conventional "doom and gloom" by saying tax-free municipal bonds are still worth holding. And I like owning real estate assets in various forms.

Sure, things can change. We'll keep a watchful eye out for signs of it. But right now, the facts tell us that things in the U.S. are much better than the pessimists would have you believe. That's why it's still a good idea to be invested in America.

No comments:

Post a Comment