by Eric Parnell

How do you stop a man from printing another $1 trillion of

the global reserve currency? This is seemingly an impossible task to

achieve. With inflationary pressures still subdued, the U.S. Federal

Reserve remains compelled to act as aggressively as possible in an

ongoing effort to jump-start the economy and bring down stubbornly high

unemployment. Never mind that the $2.3 trillion already

printed by the Fed since the outbreak of the financial crisis several

years ago has not resulted in a sustainably strong economic recovery to

this point. Perhaps another $1 trillion or more will finally do the

trick. But what are the unintended consequences to these repeated and

extreme actions? And what if anything can finally grab the attention of

the Fed to put a stop to the money printing? Oil may ultimately prove to

be the kryptonite that finally weakens the resolve of Chairman Bernanke

and the Fed's printing press.

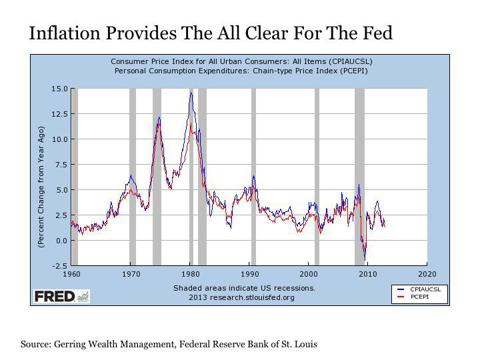

Is Inflation Really Under Control?

This

is an important question to consider before going any further. At first

glance, it appears that inflationary pressures are benign. Two

well-known and widely used measures of inflation illustrate this point.

These are the U.S. Consumer Price Index (CPI) reported by the Bureau of Labor Statistics (BLS)

and the Personal Consumption Expenditure (PCE) price index compiled by

the Bureau of Economic Analysis (BEA). Both are derived using

statistical methodologies in an effort to best estimate changes in the

price level of consumer goods and services over time. And an examination

of both of these measures strongly suggests that inflationary pressures

are under control and pricing stability reigns, with the year over year

change in prices for both measures both comfortably between 1% and 2%.

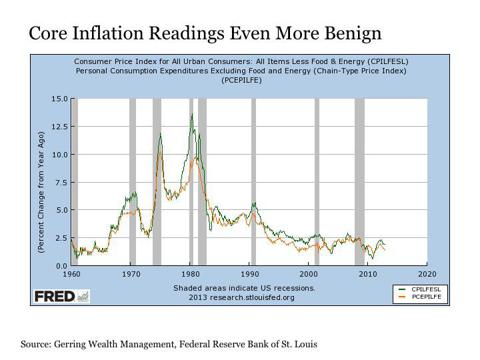

The

core inflation readings that exclude the more volatile food and energy

components reinforce further the idea that inflation is under control.

And these core figures are particularly important for these are the

readings that the Fed relies upon to monitor pricing pressures.

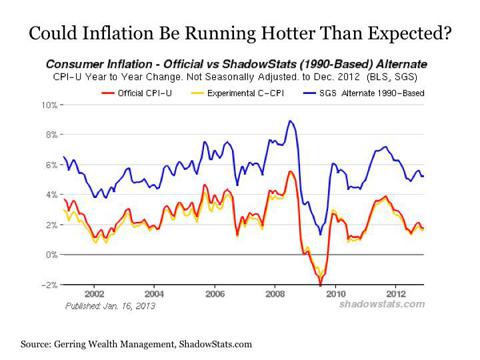

However,

the fact that both the CPI and PCE suggest that inflation is under

control does not necessarily end the discussion. It is important to note

that both readings are based on statistical models that are designed to

estimate changes in prices to the best of their ability. And I have no

doubt that those who have constructed and are maintaining these models

at the BLS and BEA are applying what they have determined to be the most

statistically accurate assessments of pricing. But it is important to

still point out that these are still estimations and not necessarily

statements of fact. For how a model is constructed and the inputs used

can lead to output that can vary widely over time.

For example, John Williams at ShadowStats.com

provides alternative inflation charts focusing on the CPI. Recognizing

that the BLS changed their estimation methodology in both 1980 and 1990,

he provides a look at how inflation would look today if these previous

models were still in use. Under the pre-1990 model, inflation today

would not be considered under control but instead running fairly hot at

over 5%.

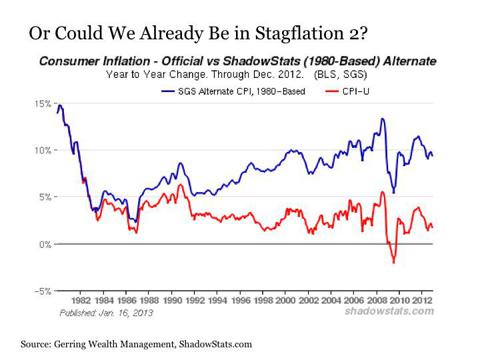

And

under the pre-1980 model, the talk today would likely be about the

return of 1970s style stagflation, not relative pricing stability.

These

examples do not necessarily suggest that we have an inflation problem

today. But what they do suggest is the possibility of an inflation

problem that may already be lurking undetected under the surface. Of

course, any conclusions about prices depend on the measuring methodology

in the end.

And who among the average consumer can really argue with the Fed's conclusions about price stability anyway.

Even if it feels like we may be paying much more for goods and services

than we did in the past, each of us are only one in a vast population

of consumers and are limited in our ability to clearly demonstrate that

we actually have an inflation problem today. It's not as though we have a

billboard that announces the daily price of goods and services in our

economy. This is true, of course, with the exception of one key item

that all Americans need to consume every single day.

What About Oil?

Let

us move forward under the assumption that pricing pressures are under

control, since this is what the Fed is seeing in their models. What then

has the potential to rattle the Fed's cage on the inflation front

whether it shows up in the official statistics or not? This product is

oil. And higher prices related to oil are already arriving at a gas

station near you thanks to the Fed's latest QE3 stimulus program.

The

fact that the Fed largely ignores food and energy prices in focusing on

the core inflation readings instead is another subject for debate in

the statistical modeling process. The justification for excluding these

two items is based on the notion that both categories experience highly

volatile price swings that fail to persist in a sustained price change

over time. But here's the problem. Whereas price changes in these

categories may not have persisted over time in the past, they have

absolutely persisted over the last decade.

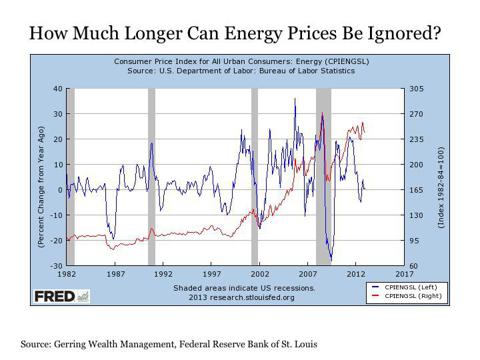

An

examination of energy in particular highlights this point. From the

early 1980s up until the year 2000, energy prices would experience wild

short-term swings (the blue line on the chart above) but underlying

prices would remain relatively stable (the red line on the chart above).

This, of course, began changing dramatically at the start of the new

millennium, as the violent price swings were not neutralizing themselves

out as they had in the past but instead have been accumulating into

sustained price increases at a rate of +7.5% per year on average over

the last decade. Putting this in simpler terms, the price of gasoline

was still consistently below $2 per gallon in the U.S. back in 2005.

Eight years later in 2013, the notion of seeing gasoline below $3 per

gallon seems far-fetched. And the prospects of gas prices rising

sustainably past $4 per gallon or even $5 per gallon in the near-term

are more than realistic.

In short, it is difficult to continue

looking past food and energy prices when assessing inflation, for the

increases in these categories are not only persisting but are also

increasingly serving as a tax on the purchasing power of consumers.

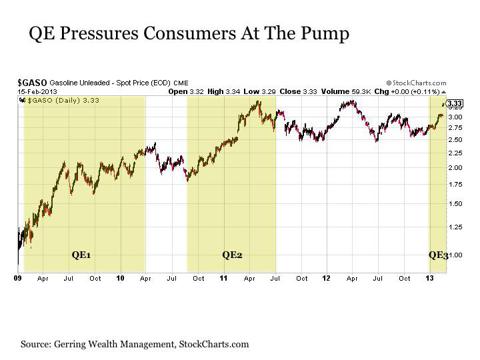

Unfortunately,

the Fed is stoking the fire under energy prices with its latest QE3

stimulus program. It is not just stock prices that float higher day

after day completely drunk on Fed liquidity. It is also energy prices

including the staple commodities of oil and gasoline. And dating back to

the beginning of the financial crisis, when the Fed has engaged in a QE

stimulus program, energy prices including gasoline have floated

steadily higher.

An

important distinction is worth noting about QE and asset prices. It's

not just any QE that gooses the prices of stocks and commodities higher.

Instead, it is specifically U.S. Treasury purchases by the Fed that

causes the market melt ups, for this specific strategy provides the

daily injections of liquidity that float the markets higher almost

daily. This is why the latest QE3 program launched in September 2012 was

falling flat in asset markets until recently, for it was not until

Treasury purchases commenced at the beginning of January 2013 that asset

prices began steadily inflating.

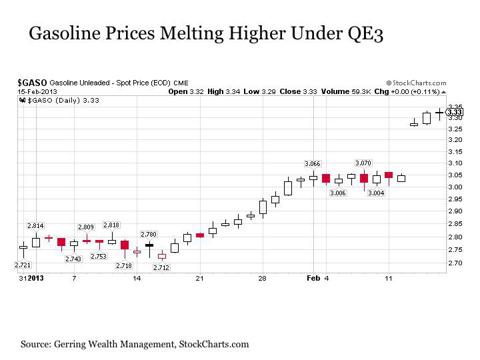

Since

the start of the year, the rise in gasoline prices has been both sharp

and persistent. Heading into 2013, the spot price of unleaded gasoline

was lingering between $2.70 and $2.80 per gallon. But once the forces of

QE finally latched on to gasoline prices starting on January 17, the

subsequent rise has been almost relentless. Over the past month,

unleaded gasoline prices have risen in 18 out of the last 22 trading

days. The cumulative effect has been a +20% rise in the spot price so

far this year.

In short, the Fed's dogged efforts to try and

increase stock prices for the roughly half of Americans that own stocks

today according to a Gallup poll in order to create a wealth effect that

just might marginally increase economic growth at some point down the

road is coming at a cost of effectively taxing all Americans today who

rely on gasoline to drive their cars and petroleum products to heat

their homes. No wonder we have yet to see any sustained benefit to the

economy from QE to date. Perhaps it is even hurting more than helping at

this stage.

The Fed's Pain Threshold For Higher Gas Prices

The

folks at the Fed are smart people. They have to know that QE is

directly juicing not only stock prices but also energy prices including

gasoline. And unlike nearly all other goods and services in our economy,

the price of gasoline is one that is projected on big billboards

throughout the streets of our respective towns each and every day. And

while companies can narrow the width of men's ties, cut down the length

of toilet paper rolls and shrink the size of popsicles in order to hide

price inflation in most other parts of the economy, a gallon of gasoline

is always going to be a gallon of gasoline. Thus, the price at the pump

is the one key data point on inflation where there is absolutely

nowhere to hide. The price of gasoline is announced loudly each and

every day, and it is critical to wonder exactly what the price threshold

will be when consumers begin to riot.

Looking ahead, it is highly

likely that we will see $4 per gallon gasoline perhaps as early as the

spring. And a run at $5 per gallon is certainly possible by the time we

are in the midst of the peak summer driving season. While it is almost a

given that the completely nonsensical, absolute garbage political

rhetoric about greedy oil companies will return to our airwaves if and

when this gasoline price rise occurs, the truth will remain that the

blame for the rise in energy prices will almost entirely rest at the

feet of the Fed. And whether they say so or not, they are smart enough

to know that this is true.

So exactly what gasoline price point

sets off public alarms remains to be seen. But it will become

increasingly difficult for Fed officials to justify to the American

people that we do not have an inflation problem when gas prices at the

pump are screaming higher. And this will be true whether the Fed is

receiving the blame for the price rise from the public or not. Whether

the rising price of gasoline ultimately proves to be Bernanke's

kryptonite for further QE will be a critical theme to watch as we move

into the middle part of the year.

In the meantime, it is

worthwhile to prepare your portfolio for such an outcome. And focusing

on oil and gas stocks that are highly correlated with rising energy

prices is an attractive theme. Representative names include Exxon Mobil (XOM), Chevron (CVX), Occidental Petroleum (OXY) and Apache (APA),

the last of which was absolutely drubbed late last week and is now

oversold on a variety of technical readings. BHP Billiton (BHP) is another attractive offering for a more diversified energy and mining allocation.

No comments:

Post a Comment